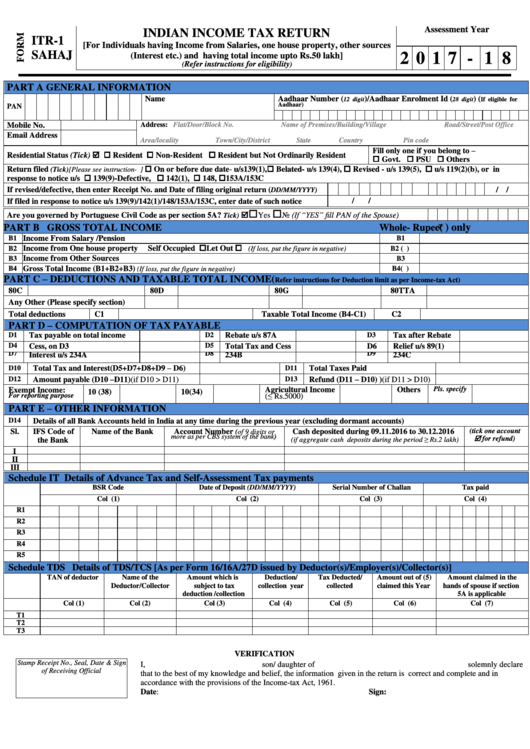

Step 7: In the next screen, click on the ‘Let’s Get Started’ button. Step 6: In the next screen, select the ITR form under ‘I know which ITR Form I need to file’ and proceed. Step 5: Select your status and click on the ‘Continue’ button. Import draft ITR filled in Online mode or import JSON generated from Excel/HTML utility.Īfter importing or downloading data, proceed to file the return.After clicking ‘File returns’ under the ‘Returns’ tab, select any of the below options:. Step 4: Considering you are filing a return for the first time. Pre-filled Data: Select this tab to see all the pre-filled ITR information which you had previously imported into the utility.Draft Version of Returns: Select this tab if you want to see the draft version of your returns (already executed filing) and click on ‘edit’.Returns: Select this tab if you are filing the return for the 1st time, then click on ‘File returns’ in this tab.Step 3: In the next screen, you can see three tabs. Step 2: Extract the downloaded zip folder and install the utility. Go to e-File > Income Tax Returns > File Income Tax Return > Select the relevant Assessment Year and Mode of Filing (Offline). You can also download the utility after login into your e-filing account. You can download the offline utility through the income tax e-filing portal at Step 1: Under the ‘Download’ section, select the relevant assessment year and click on the ‘utility’ link under the ‘Common Offline Utility (ITR 1 to ITR 4)’ section. How to download ITR-1, ITR-2, ITR-3 and ITR-4 offline utilities? To start with, the taxpayer has first to download the offline utility

Let us understand how to file ITR returns through offline utility. The income tax department allows taxpayers to file income tax returns using offline mode.

0 kommentar(er)

0 kommentar(er)